Timely payment collection is critical to the financial health of any healthcare organization. Yet, many providers continue to struggle with slow or inconsistent patient payments—even as patient financial responsibility has grown significantly. While much of the conversation around collections centers on technology or process, the real obstacles often lie in outdated beliefs that limit action.

In this blog, we’ll debunk three of the most common myths holding healthcare organizations back from collecting faster—and share actionable strategies to overcome them. Whether you’re part of a small independent practice or a large multi-specialty group, challenging these misconceptions can unlock real gains in revenue and patient satisfaction.

Myth #1: Patients Will Pay Eventually—It Just Takes Time

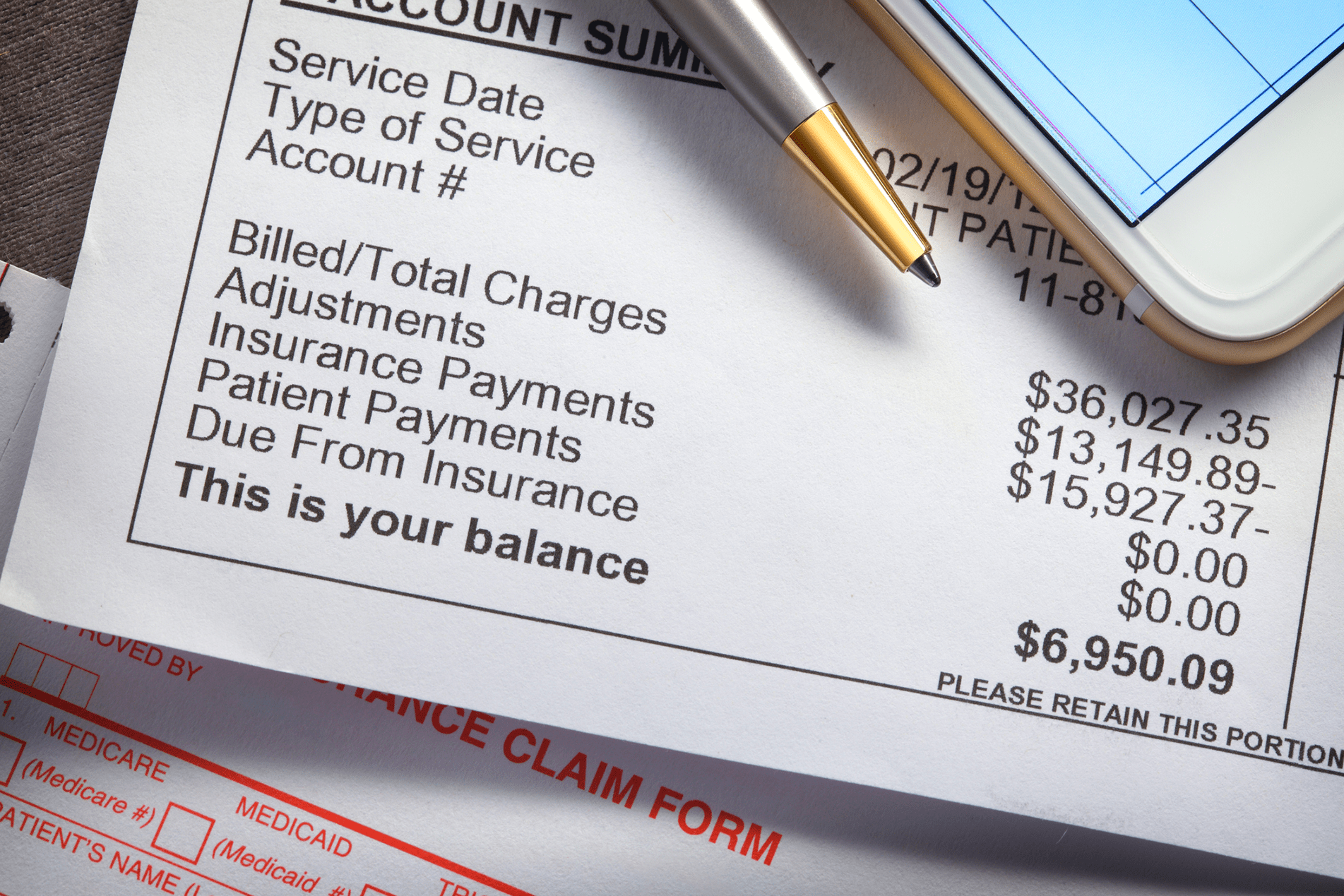

This belief may have held true in the past, but today’s healthcare economy has changed. With rising deductibles and co-pays, patients are now the third-largest payer behind Medicare and Medicaid. Waiting for payments to trickle in months after a visit is no longer a sustainable model.

The Reality:

Patients are consumers—and they expect convenient, modern billing experiences. The longer you wait to request payment, the lower your chances of collecting. According to MGMA, practices recover only 20% of a bill 90 days after the date of service.

How to Address It:

- Offer upfront estimates: Use real-time eligibility tools to provide cost estimates before the visit. Transparency increases the likelihood of on-time payments.

- Collect at point of service: Train front-desk staff to ask for co-pays or partial payments during check-in or checkout.

- Send immediate digital invoices: Don’t wait for paper statements. Trigger mobile-friendly bills immediately after the visit.

- Follow up quickly and consistently: Automate reminders within 48 hours post-visit and use multiple channels (SMS, email, voice).

Myth #2: Paper Statements Are Still the Most Reliable Way to Bill Patients

Many organizations still rely heavily on paper billing—citing tradition, compliance concerns, or the belief that some patients “just prefer it.” But in reality, paper-based billing is slow, expensive, and often ignored. Mail gets lost, delayed, or simply tossed aside. And it’s no match for today’s digital-first patient expectations.

The Reality:

Patients live on their smartphones. They pay for food, utilities, and even their taxes online. Healthcare should be no different. A 2022 survey by Instamed found that 78% of patients want to pay their medical bills online—and 72% are more likely to pay when digital options are available.

How to Address It:

- Switch to digital-first billing: Make email and text the default for all billing communications. Offer paper only by request.

- Use patient portals and mobile apps: Provide multiple secure channels to review and pay balances anytime, from any device.

- Enable one-click payment options: Reduce friction with Apple Pay, Google Pay, and saved credit card options.

- Automate reminders and receipts: Keep patients in the loop with confirmation texts and payment history notifications.

Myth #3: Patients Won’t Pay Until They’re Sent to Collections

Some organizations assume that the only way to get serious about collections is to wait until a patient’s account ages significantly, then outsource it to a third-party collections agency. While this may recover a portion of the revenue, it comes at a cost—both in terms of patient trust and actual dollars recovered.

The Reality:

Sending patients to collections should be a last resort, not a standard operating procedure. Once a patient is in collections, the odds of recovering full payment drop dramatically. Worse, the experience often damages the provider-patient relationship, leading to lost future revenue and negative reviews.

How to Address It:

- Use proactive payment plans: Let patients set up recurring payments or choose due dates based on their budget.

- Send early, friendly reminders: A gentle nudge within a few days of the visit often gets faster results than threats down the line.

- Segment patient balances: Treat small balances and high-dollar amounts differently—personalized approaches improve results.

- Avoid surprise billing: Make pricing clear upfront, and send reminders before a bill is due, not just after it’s late.

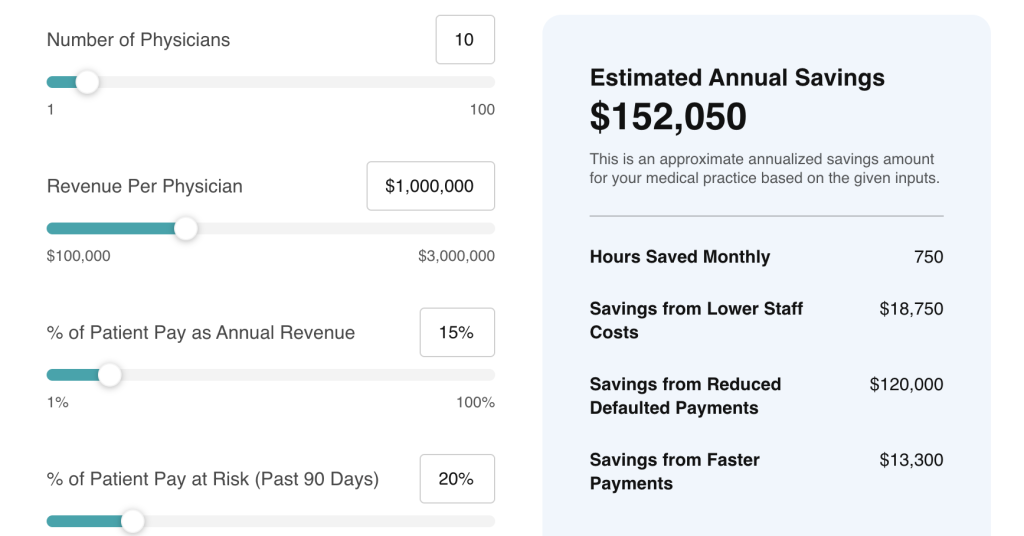

The Role of Technology in Debunking These Myths

Breaking free of these myths isn’t just about mindset—it’s also about having the right tools. Modern patient engagement and billing platforms can automate communications, streamline payments, and integrate directly into your existing EHR or practice management system. These tools take the guesswork and manual labor out of collections, allowing your staff to focus on care rather than chasing payments.

Key Features to Look For:

- EHR integration (e.g., athenahealth, Epic, eClinicalWorks)

- Two-way SMS and email reminders

- Automated billing workflows

- Real-time patient payment dashboards

- PCI-compliant digital payment options

With the right platform, collecting payments becomes a natural, seamless part of the patient experience.

Final Thoughts: Collecting Faster Starts With Rewriting the Narrative

Healthcare organizations can no longer afford to wait for payments to arrive slowly, hope paper statements do the job, or treat collections as inevitable. By challenging outdated myths and embracing a modern, digital-first strategy, providers can dramatically improve both revenue cycle performance and patient satisfaction.

At Rivia Health, we help healthcare organizations modernize the way they communicate and collect. Our platform automates patient billing reminders, enables fast digital payments, and integrates directly with systems like athenahealth to reduce friction and increase results.

Let’s debunk the myths—and help you collect faster, smarter, and more compassionately.