Managing patient accounts receivable (A/R) has become one of the most pressing challenges in healthcare today. With rising patient responsibility, high-deductible health plans, and an increasingly complex revenue cycle, practices are facing more unpaid balances than ever before. For many organizations, inefficient A/R management translates to strained cash flow, increased staff burden, and reduced profitability.

But it doesn’t have to be this way. With the right strategies, technology, and workflows, practices can reduce days in A/R, improve patient satisfaction, and collect more revenue faster.

This guide will cover everything you need to know about managing patient A/R effectively—from understanding the basics to implementing advanced collection strategies.

Table of Contents

What Is Patient Accounts Receivable (A/R)?

Why Patient A/R Is Growing

The Financial Impact of High Patient A/R

The Hidden Costs of Poor A/R Management

Key Metrics for Tracking A/R Performance

Traditional Approaches vs. Modern Solutions

Best Practices for Reducing Patient A/R

Clear Financial Policies

Transparent Cost Estimates

Point-of-Service Collections

Patient Education

Staff Training

Technology & Automation

How Patient Communication Shapes Collections

Flexible Payment Options: Meeting Patients Where They Are

Leveraging Automation to Improve Collections

Integrating Patient Payments with Your PM/EHR System

Preserving Patient Relationships While Collecting

Case Study Examples (Hypothetical)

Why Rivia Health Is a Better Way to Manage Patient A/R

Action Plan for Practices

1. What Is Patient Accounts Receivable (A/R)?

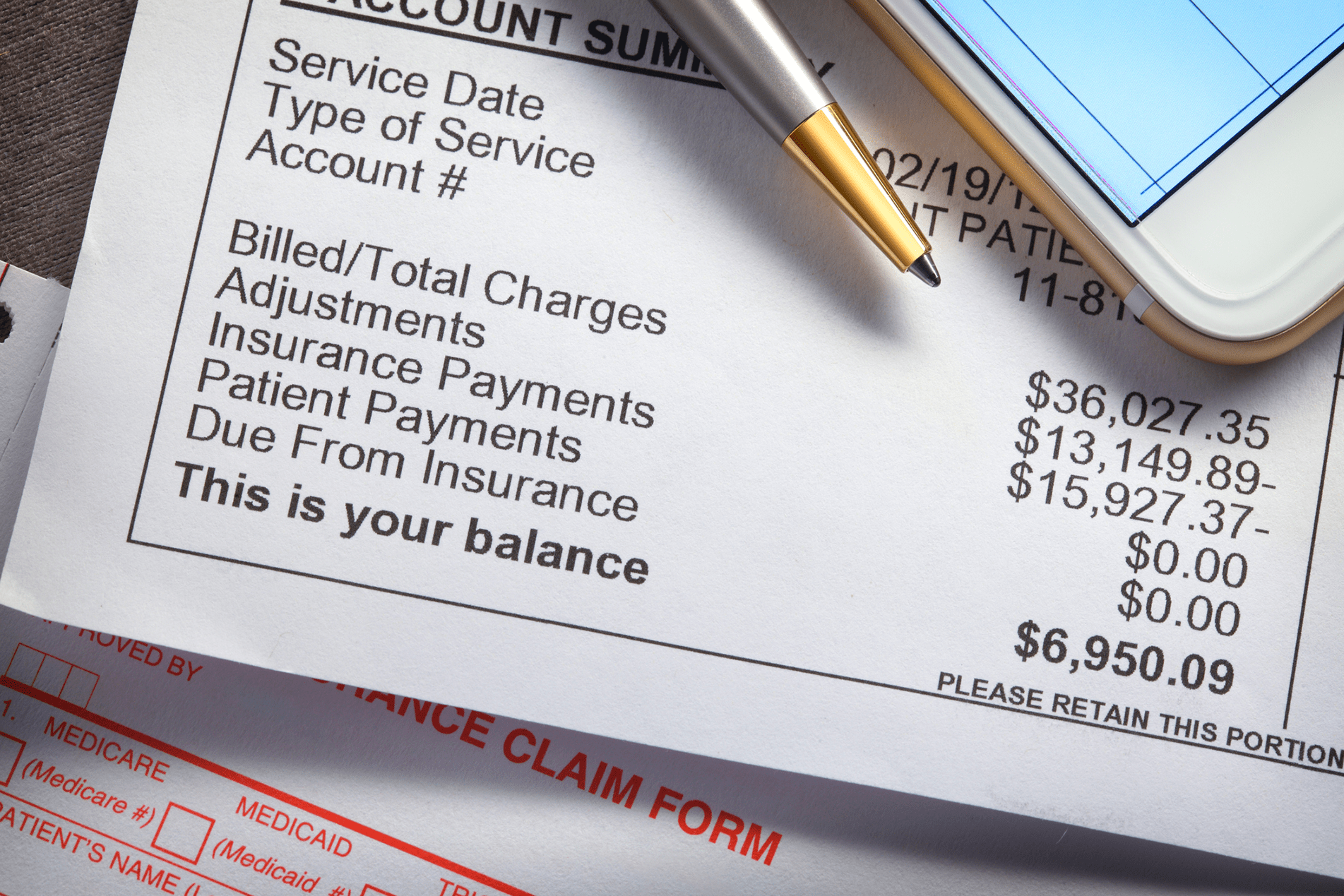

Accounts receivable (A/R) refers to the money owed to a practice for services already delivered. While insurance companies account for a large portion of A/R, patient balances now make up an increasing share of outstanding receivables.

Patient A/R specifically refers to balances that are the responsibility of patients after insurance has paid its portion—or, in cases of self-pay, the entire balance. These balances often include deductibles, co-pays, co-insurance, and services not covered by insurance.

Managing patient A/R effectively means ensuring that these balances are collected in a timely, cost-effective, and patient-friendly manner. Practices must balance their need for financial stability with their patients’ need for affordability and clarity.

2. Why Patient A/R Is Growing

The rise in patient responsibility is not a coincidence—it’s the result of structural changes in the healthcare system. Over the past decade, high-deductible health plans (HDHPs) have become increasingly common. Many patients are now responsible for thousands of dollars in upfront costs before their insurance contributes a cent. Even after deductibles are met, out-of-pocket co-insurance percentages can add substantial financial burden.

At the same time, the cost of living has risen sharply. Patients often prioritize essentials like rent, mortgage payments, or utilities over medical bills. The result is delayed or missed healthcare payments, not necessarily because patients are unwilling, but because they simply lack the resources or the flexibility to pay immediately.

To make matters worse, many patients find medical billing processes confusing. They may not fully understand their insurance coverage, what portion of a bill is their responsibility, or why they are receiving multiple statements for the same visit. Confusion breeds inaction—and unpaid balances sit longer on the books.

3. The Financial Impact of High Patient A/R

When balances aren’t collected quickly, the financial repercussions ripple across a practice. Cash flow slows down, meaning the organization has less working capital for payroll, rent, technology, and other essential expenses.

As time passes, the likelihood of collection plummets. Research shows that once a balance is more than 90 days old, the probability of recovery may fall below 20%. That means every day spent waiting on patient payment dramatically reduces the odds of success.

In addition, unpaid balances often end up being written off entirely. Write-offs erode profitability, and for smaller practices, even modest losses can be crippling. For larger groups, high A/R balances often translate into higher operating costs, as additional staff time is required to chase down payments.

4. The Hidden Costs of Poor A/R Management

The impact of inefficient A/R management extends far beyond dollars and cents. There are hidden costs that often go unnoticed but contribute significantly to the overall burden.

For staff, the constant cycle of phone calls, mailed statements, and manual reconciliation is draining. Many front-office and billing team members report burnout from the repetitive and stressful nature of chasing payments. Staff turnover increases, and the cost of training replacements rises in turn.

Patients also feel the strain. When they receive multiple confusing bills or aggressive follow-up calls, frustration builds. Patients may feel embarrassed or harassed, which can erode trust in the practice. Negative experiences often translate into negative online reviews, hurting reputation and making it harder to attract new patients.

Finally, compliance risks can’t be ignored. Mishandling billing communications or using inappropriate language during collections can create legal exposure, especially under consumer protection laws. Practices must manage A/R not just efficiently, but also carefully.

5. Key Metrics for Tracking A/R Performance

Improving A/R management starts with measurement. Without a clear understanding of where balances stand, it’s nearly impossible to implement meaningful improvements.

One of the most important indicators is Days in A/R, which measures how long, on average, it takes to collect a payment. Shorter days in A/R generally indicate healthier cash flow. Another critical measure is the A/R aging report, which breaks down receivables by time buckets: 0–30, 31–60, 61–90, and over 90 days. This report highlights which balances are slipping into dangerous territory.

Practices should also monitor their collection rate, or the percentage of patient balances successfully collected. A declining collection rate may indicate ineffective processes or patient dissatisfaction. The cost-to-collect is another useful measure, calculated by dividing the total administrative costs of billing and collections by the revenue collected. High costs suggest inefficiency and wasted resources.

Finally, the patient responsibility rate—the portion of revenue coming directly from patients—is an essential contextual metric. As this figure grows, practices must adjust strategies to ensure their processes can handle the increased financial responsibility shifting to patients.

6. Traditional Approaches vs. Modern Solutions

Historically, patient A/R management has been a manual, paper-heavy process. Practices mailed paper statements once a month, called patients when balances grew old, and eventually sent unpaid accounts to third-party collection agencies.

While these methods may have been sufficient in the past, they are increasingly ineffective today. Patients expect digital convenience, not paper letters. Manual phone calls take significant staff time and are often ignored. And outsourcing to collection agencies not only reduces the amount of revenue practices recover, but also risks damaging patient relationships.

Modern solutions flip this model. Instead of waiting until a balance ages into delinquency, tools like Rivia Health help practices proactively engage patients the moment a balance is due. Automated text messages and emails replace paper mail. Mobile-first payment links make it easy for patients to pay instantly. Payment plans and flexible options give patients control over how they resolve balances. And automated reconciliation ensures staff aren’t spending hours posting payments by hand.

7. Best Practices for Reducing Patient A/R

Establish Clear Financial Policies

Practices should set expectations before services are delivered. Patients need to understand their financial responsibility at the time of scheduling and again at check-in. Transparent financial policies reduce surprises and increase the likelihood of on-time payments.

Provide Transparent Cost Estimates

Surprise bills are one of the leading reasons patients delay payment. By providing cost estimates before care—especially for elective or high-cost procedures—practices can minimize confusion and ensure patients are financially prepared.

Collect at the Point of Service

The best time to collect a payment is when the patient is in the office. Collecting co-pays, deductibles, or known balances at check-in or check-out reduces A/R before it even begins. Training staff with scripts and tools can make these conversations smoother and less stressful.

Educate Patients About Their Balances

Medical billing is complicated, and patients often don’t fully understand what they owe or why. Providing plain-language explanations and FAQs can demystify statements and reduce friction. Practices that take the time to educate patients build trust and increase payment compliance.

Invest in Staff Training

Your staff is on the front lines of collections. Equipping them with proper training—both technical and interpersonal—empowers them to handle financial discussions with empathy and confidence.

Leverage Technology and Automation

Finally, automation is no longer optional. Tools that automate payment reminders, allow mobile payments, and reconcile balances within your PM/EHR system save staff hours each week and ensure no patient falls through the cracks.

8. How Patient Communication Shapes Collections

Communication is one of the most overlooked aspects of A/R management. The way a practice communicates with patients can mean the difference between a prompt payment and a lingering balance.

Digital-first communication is key. Patients are far more likely to respond to a text message or email than a paper statement. These digital channels also allow practices to deliver reminders more frequently, in smaller, gentler touches, rather than waiting for a single large bill to be mailed.

Tone matters as well. Patients respond more positively to friendly, supportive language than to aggressive or threatening collection tactics. A simple reminder framed as, “We want to make this easy for you—click here to pay your balance,” is far more effective than a stern warning.

9. Flexible Payment Options: Meeting Patients Where They Are

For many patients, affordability is the biggest barrier to paying medical bills. Practices that only offer “pay in full” options set themselves up for failure.

Offering flexible payment plans allows patients to spread out costs over time, reducing financial stress and increasing collection rates. Auto-pay features, where patients can schedule recurring payments, further streamline the process and ensure consistency.

The more payment channels you offer—credit/debit, HSA/FSA, online, mobile—the more likely patients are to find a method that works for them. Meeting patients where they are, both financially and technologically, creates a win-win scenario.

10. Leveraging Automation to Improve Collections

Automation doesn’t just save staff time—it transforms the collections process. Automated systems can trigger reminders the moment a balance posts, schedule follow-ups at regular intervals, and stop reminders once a payment is made.

This ensures no balance is overlooked and no staff time is wasted manually tracking patient accounts. Automation also reduces errors, since payments are posted directly into the practice’s PM/EHR system.

Over time, practices that embrace automation see significant improvements in their collection rate, reductions in days in A/R, and happier staff who no longer spend their days chasing balances.

11. Integrating Patient Payments with Your PM/EHR System

A critical but often overlooked aspect of A/R management is system integration. When patient payment tools don’t integrate with a practice’s PM or EHR, staff are forced to manually reconcile payments—a process that is both time-consuming and prone to error.

With integrated systems, payments post automatically, balances are updated in real-time, and staff always have an accurate view of where accounts stand. This consistency reduces confusion for both staff and patients, while freeing up hours of administrative work each week.

12. Preserving Patient Relationships While Collecting

Collections should never come at the expense of patient trust. A harsh or aggressive approach may yield short-term revenue, but it risks long-term patient loss.

Practices that focus on patient-friendly communication, flexible options, and transparent processes can preserve strong patient relationships while still collecting effectively. Patients who feel respected and supported are far more likely to return for future care—and to pay their balances on time.

13. Case Study Examples (Hypothetical)

Consider a primary care practice that struggled with high A/R balances over 90 days. After implementing automated digital reminders and mobile payment options, they reduced their over-90-day A/R by 40% in just six months.

A specialty clinic faced low point-of-service collections. By providing upfront cost estimates and training staff to discuss balances compassionately, they increased point-of-service payments by 30%, reducing downstream collection costs.

Finally, a multi-location group practice was overwhelmed by manual reconciliation. After adopting automated reconciliation through an integrated system, they cut billing staff workload in half, freeing them to focus on higher-value tasks.

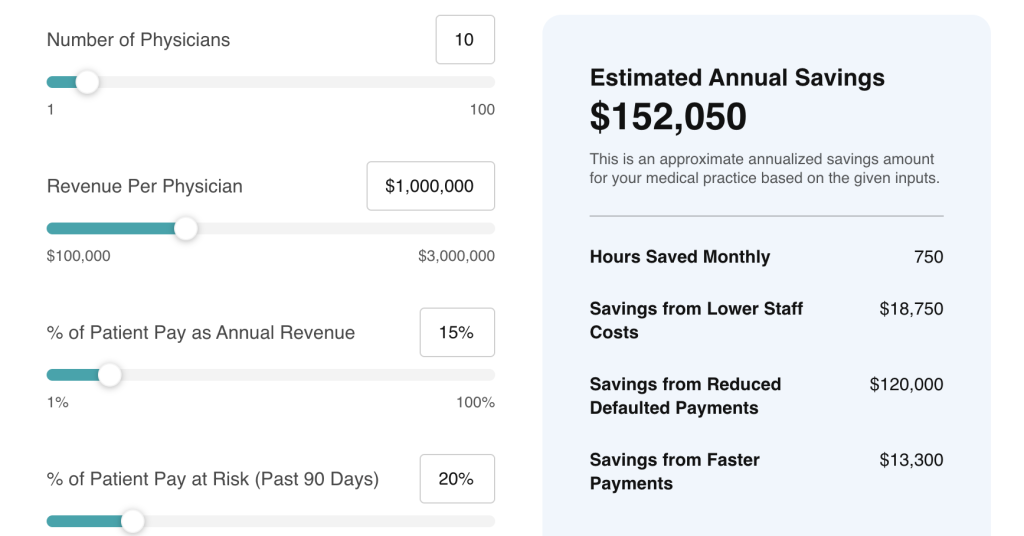

14. Why Rivia Health Is a Better Way to Manage Patient A/R

Traditional methods like paper statements, manual calls, and outsourcing to collection agencies simply don’t work in today’s healthcare environment. They’re slow, costly, and often alienating for patients.

Rivia Health offers a better path. By automating payment reminders, providing flexible digital payment options, and integrating seamlessly with existing PM/EHR systems, Rivia helps practices collect more revenue with less effort.

The approach is patient-friendly, ensuring that practices preserve relationships while improving financial outcomes. It’s also cost-effective—because unlike collection agencies, which take a large cut of recovered revenue, Rivia enables practices to keep more of what they collect.

15. Action Plan for Practices

To start improving A/R management today, practices should:

Review and update financial policies to set clear patient expectations.

Train staff on proactive and compassionate payment discussions.

Begin offering cost estimates and flexible payment options upfront.

Transition from paper statements to digital-first communication.

Implement a modern solution like Rivia Health to automate reminders, payments, and reconciliation.

Conclusion

Patient A/R is one of the biggest financial challenges facing medical practices today—but it’s also one of the most solvable. By shifting from outdated, manual approaches to patient-centered, technology-driven solutions, practices can reduce aging receivables, improve cash flow, and strengthen patient relationships.

Traditional methods are no longer sufficient. The future of A/R management lies in automation, digital engagement, and proactive strategies.

Rivia Health offers the tools and expertise to help practices stop leaving money on the table and start capturing payments with ease.