In the ever-evolving landscape of healthcare, one area remains stubbornly outdated: billing. While nearly every other industry has embraced digital transformation, many healthcare organizations continue to rely on paper-based billing systems. On the surface, paper billing might seem harmless or even traditional—but the truth is, it’s a silent revenue killer and a drag on patient satisfaction.

For medical practices, health systems, and billing teams aiming to improve revenue cycle management, reduce operational costs, and deliver a better patient experience, digital billing isn’t just an option—it’s a necessity.

In this article, we’ll explore the hidden costs of paper billing, how it negatively impacts both providers and patients, and why digital billing solutions—like those offered by Rivia Health—are quickly becoming the standard for forward-thinking healthcare organizations.

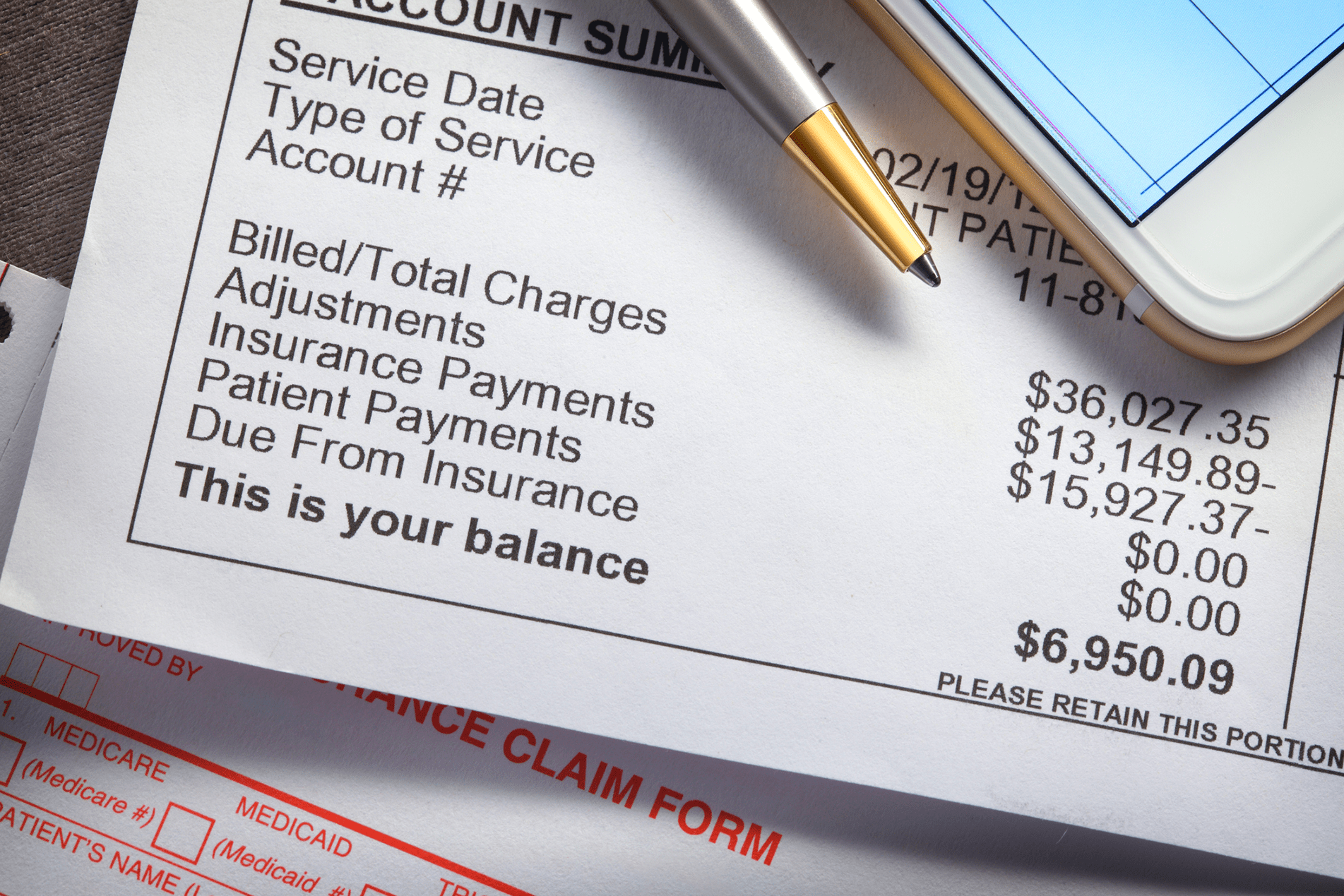

The Real Cost of Paper Billing

- Printing, Postage, and Materials Add Up Quickly

Each mailed paper statement carries a tangible cost. When you factor in paper, envelopes, ink, printing equipment, postage, and staff time for handling and mailing, the expense can range from $3 to $7 per bill. Multiply that by hundreds or thousands of patients each month, and the numbers become staggering.

More importantly, that investment doesn’t always result in timely payment. In fact, the average turnaround time for paper billing exceeds 21 days. Compare that to the almost immediate payment cycles achievable through digital channels, and the inefficiency becomes clear.

- Manual Processes Drain Staff Resources

Sending paper bills requires significant administrative labor. Staff must print, fold, stuff, stamp, and sometimes manually track follow-ups. These repetitive tasks take time away from higher-value activities such as patient engagement, claims follow-up, or front-desk support. As labor costs rise across the industry, automating billing processes through digital tools is a smart way to free up internal bandwidth.

- Lost or Delayed Mail Leads to Missed Revenue

Postal delays, lost mail, or incorrect addresses can result in missed or late payments. Patients who don’t receive their bill—or receive it weeks after their visit—are less likely to pay promptly. In worst-case scenarios, the bill is forgotten entirely, increasing the chance of write-offs or collections.

How Paper Billing Hurts the Patient Experience

- It Doesn’t Match Modern Expectations

Patients today are digital consumers. They bank online, shop online, and manage much of their lives from their smartphones. When healthcare is the only part of their lives that still communicates via paper, it creates a disconnect. Patients expect the same digital convenience from their healthcare providers that they get from their favorite brands.

Requiring a paper check or a call to the billing office to make a payment feels outdated and inconvenient. This friction often results in delayed or missed payments—not because the patient is unwilling, but because the process makes it harder than it needs to be.

- It Can Cause Confusion and Anxiety

Paper bills often lack clarity. Patients may not understand what the charge is for, how much they owe, or how their insurance applied to the visit. Without easy access to itemized explanations or a support contact, confusion turns into frustration. Patients want transparency—and they want it fast.

Digital billing platforms can include links to detailed explanations, FAQs, or even chat support, making it easier for patients to understand and resolve their bills.

The Digital Advantage: Speed, Savings, and Satisfaction

- Faster Payments

Digital billing accelerates the entire payment cycle. Instead of waiting days or weeks for a paper bill to be printed, mailed, and processed, patients can receive a secure link via text or email within hours of their visit. Most importantly, they can pay with a few clicks—without creating a login or remembering a portal password.

Practices that implement digital payment solutions often see payment turnaround times drop from weeks to days—or even same-day payments.

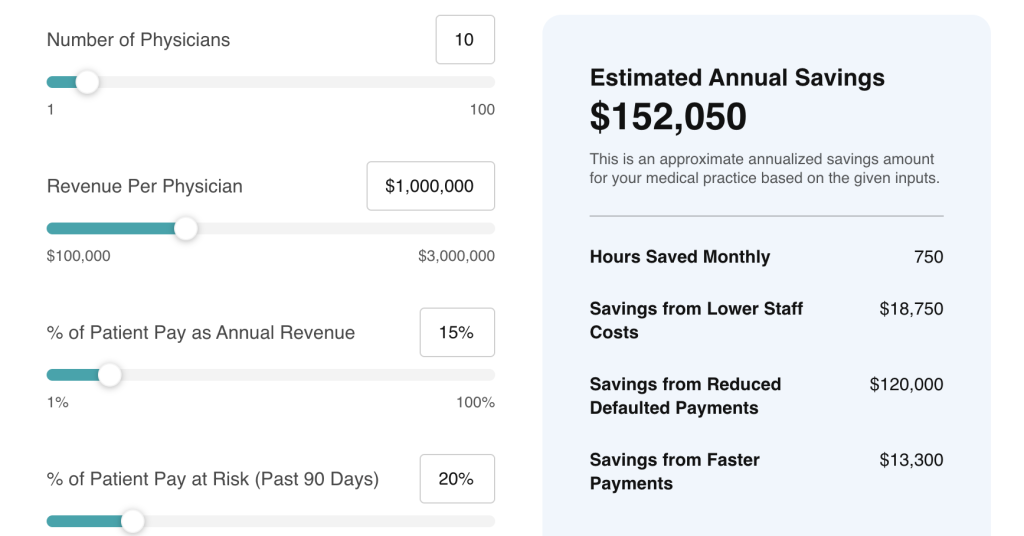

- Lower Operational Costs

Digital billing eliminates printing, postage, and much of the administrative overhead associated with paper workflows. Automated reminders and smart outreach also reduce the need for manual follow-ups by staff. Over time, this adds up to thousands of dollars saved annually and allows staff to focus on more strategic initiatives.

- Improved Patient Engagement

Patients appreciate convenience. When billing is easy to understand, delivered in a timely fashion, and accessible via the device they use most—their smartphone—payment rates go up. Digital tools also allow for multiple payment options including credit cards, Apple Pay, Google Pay, and even flexible payment plans, improving the likelihood of full or partial payments.

- Better Insights and Reporting

With digital billing platforms, healthcare providers gain access to real-time data on payment statuses, patient behavior, and follow-up effectiveness. This visibility allows for more strategic revenue cycle management and quicker identification of bottlenecks in the payment process.

Rivia Health: Helping Providers Go Paperless and Get Paid Faster

At Rivia Health, we specialize in helping healthcare organizations transition from traditional, inefficient paper billing to smarter, digital-first solutions. Our platform integrates seamlessly with popular EHR and practice management systems—including athenahealth—making it easy to automate and personalize the patient payment experience.

Here’s what you can expect with Rivia Health:

- Login-free digital billing sent via secure text and email

- Faster payments through mobile-friendly, one-click checkout

- Reduced operational costs by eliminating manual billing tasks

- Happier patients thanks to clear, transparent, and convenient communication

- Improved collection rates with automated follow-up workflows and reminders

Our healthcare-specific approach ensures compliance, patient satisfaction, and measurable ROI for practices ready to modernize their revenue cycle.

Final Thoughts: The Future of Healthcare Billing Is Digital

Paper billing is a relic of the past—and a costly one at that. From delayed payments and administrative burdens to patient dissatisfaction and revenue leakage, the risks far outweigh the perceived familiarity of paper. Healthcare organizations that continue to rely on outdated billing systems will struggle to meet the demands of today’s digital-savvy patients and increasingly competitive financial environment.

Digital billing, on the other hand, offers a clear path forward. It’s faster, more cost-effective, and better aligned with the expectations of modern patients. The good news? Transitioning to digital doesn’t have to be overwhelming. With a trusted partner like Rivia Health, you can implement digital payment solutions quickly and see measurable results in weeks—not months.

Are you ready to move beyond paper and start collecting faster, with less effort? Contact Rivia Health today to learn how.