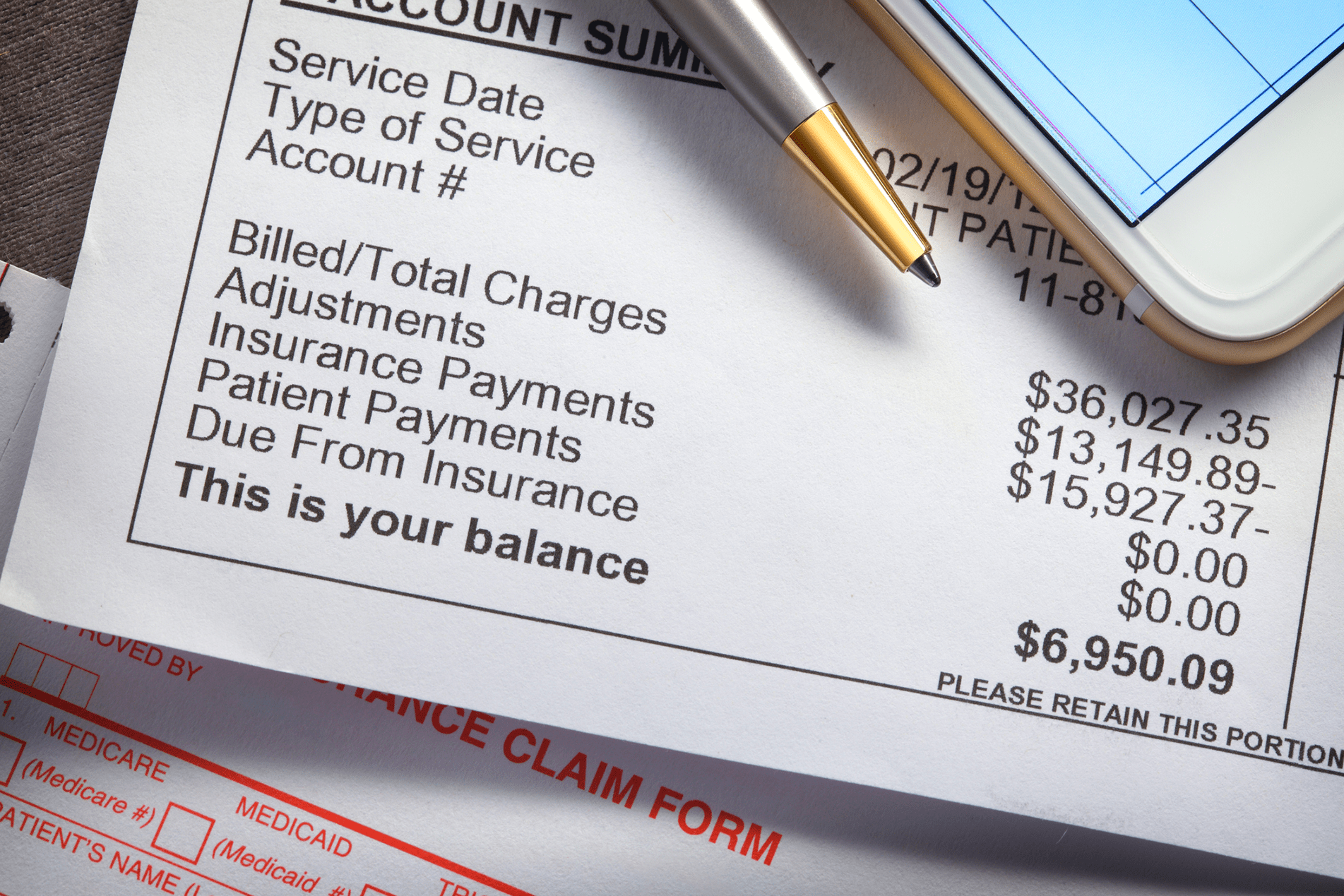

As healthcare costs continue to rise, patients are increasingly responsible for larger portions of their bills. High deductibles, coinsurance, and unexpected medical expenses can create real financial stress. For practices and health systems, this often translates into higher patient A/R (accounts receivable), delayed payments, and costly collection efforts.

One of the most effective solutions is offering patient-friendly payment plans. When designed thoughtfully, these plans reduce financial barriers, increase collection rates, and build stronger patient relationships. However, the key lies in creating guidelines that balance patient flexibility with organizational efficiency.

Below, we’ll walk through the essential elements of structuring patient payment plans, why they matter, and how your practice can set clear, consistent, and compassionate policies.

1. Minimum Balance Threshold

The Question: What’s the smallest balance that qualifies for a payment plan?

Why It Matters

If you set the threshold too high, patients with relatively small balances may still struggle to pay in one lump sum, leading to frustration or delayed payments. On the other hand, allowing every minor balance to qualify for installment payments can create unnecessary administrative work and dilute staff efficiency.

Recommendation

Evaluate your average patient balance and the administrative effort required to maintain plans. Many organizations set the minimum at $100–$250, though some go as low as $25 to accommodate patients in financial hardship.

The key is to strike a balance: make the option available where it can truly help patients, but don’t overextend staff resources on micro-balances that could be collected more easily upfront.

2. Minimum Monthly Payment

The Question: What’s the lowest monthly payment you’ll accept on a payment plan?

Why It Matters

The minimum monthly payment must be meaningful enough to reduce the balance steadily, but also reasonable enough for patients to sustain. If payments are too high, patients may default. Too low, and the balance lingers indefinitely, creating strain on cash flow.

Recommendation

Consider a tiered structure:

Under $1,000: $50 minimum monthly payment

$1,000–$5,000: $75–$100 minimum

Over $5,000: 2% of the total balance

Best Practice Spotlight

In Colorado, one model limits monthly payments to 4% of a patient’s gross monthly income—a patient-centered approach that balances financial responsibility with affordability.

By aligning payments with patients’ real-world financial capacity, you reduce defaults and increase long-term success.

3. Duration by Balance Tiers

The Question: How long should patients have to pay based on their balance amount?

Why It Matters

Duration directly affects both the patient’s financial comfort and your organization’s cash flow. Too short, and patients may be unable to keep up. Too long, and the likelihood of defaults increases while revenue is delayed.

Recommended Timeline

Under $500: Up to 6 months

$501–$1,000: Up to 12 months

$1,001–$5,000: Up to 24 months

Over $5,000: Custom arrangements, tailored to the patient’s unique situation

This tiered approach ensures patients with larger balances have the breathing room they need, while your organization maintains predictability in collections.

4. Maximum Allowable Duration

The Question: What’s the longest payment term you’ll offer, regardless of balance?

Why It Matters

While flexibility is key, setting a clear maximum protects your organization from extended risk and helps keep accounts manageable. Longer terms increase administrative costs, cash flow delays, and the chance of default.

Recommendation

Most organizations set a maximum of 24–36 months. Beyond this point, balances can become too risky and resource-intensive to manage effectively.

When defining your maximum, weigh your organization’s cash flow needs, staff capacity, and patient demographics.

5. Patient Financial Capacity

The Question: How can you incorporate ability to pay while maintaining consistency?

Why It Matters

Not every patient has the same financial situation. Rigid one-size-fits-all plans often lead to defaults, while overly flexible policies can overwhelm staff. The challenge is to assess capacity fairly while keeping guidelines consistent and transparent.

Recommendation

Develop assessment tools that consider:

Household income and size

Existing medical bills

Essential living expenses (housing, food, transportation)

This creates a framework for tailoring payment plans without arbitrary decisions, ensuring equity and sustainability.

6. Initial Deposits

The Question: Should patients make a down payment to start a payment plan?

Why It Matters

Requiring an upfront deposit can increase patient commitment and reduce risk. However, it may also create barriers for patients already in financial hardship.

Recommended Framework

Under $1,000: No deposit required

$1,001–$5,000: 5–10% down

Over $5,000: 10–20% down

Important Exception Policies

Automatic waivers should be available for:

Patients eligible for financial assistance

Households below 250% of the federal poverty level (FPL)

Those experiencing catastrophic medical events

Patients with active insurance claims or appeals

This balance ensures deposits encourage accountability without shutting out vulnerable patients.

7. Defaults and Restructuring

The Question: How will you handle missed payments and plan modifications?

Why It Matters

Even the best-designed plans may need adjustments. Patients experience job loss, medical complications, or unexpected expenses. Having a clear process prevents confusion, maintains trust, and avoids unnecessary escalations.

Recommendation

Allow 1–2 modifications per plan period

Require a good faith payment to restart after default

Document exception procedures so staff can respond consistently

By offering a safety net, you demonstrate compassion while protecting organizational integrity.

Implementation Checklist

Creating effective payment plan guidelines isn’t just about numbers—it’s also about execution. Here are the essentials:

Train staff on empathetic financial conversations

Document clear hardship exception procedures

Set a regular review schedule for policies

Monitor patient satisfaction with billing experiences

Track completion and default rates for continuous improvement

Communicate policies clearly, both verbally and in writing

Regulatory Compliance

Any payment plan policy must account for state-specific regulations and federal compliance requirements. This includes consumer protection laws, reporting obligations, and fair billing standards.

Failure to align with regulations can lead to penalties, reputational harm, or even legal action—making compliance just as critical as patient satisfaction.

The Bottom Line

Patient-friendly payment plans are more than just a financial tool—they’re a bridge between patient affordability and practice sustainability.

By setting thoughtful guidelines around thresholds, durations, deposits, and restructuring, your organization can create a framework that is both practical and compassionate.

The ultimate goal isn’t simply to collect payments—it’s to foster trust, reduce financial stress, and maintain healthy cash flow. With regular review and refinement, your plan policies can evolve alongside your patients’ needs and your organization’s goals.

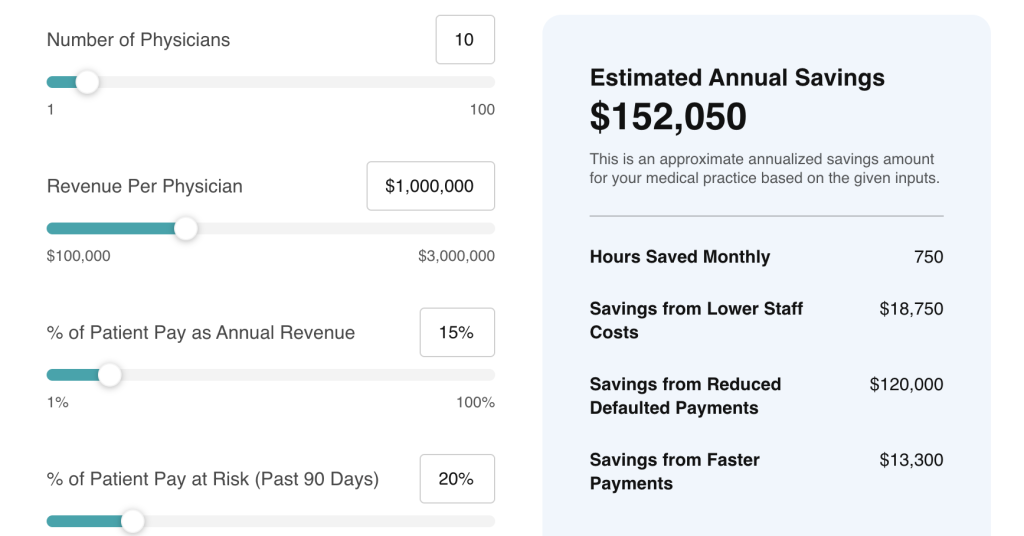

How Rivia Health Can Help

Implementing these guidelines manually can be complex and time-consuming. That’s where Rivia Health makes the difference. Our platform automates:

Patient payment reminders

Customizable payment plans

Automatic reconciliation into your PM system

Reporting to track success rates and defaults

With Rivia Health, your organization can streamline collections, reduce manual work, and create a patient-friendly payment experience that improves satisfaction and increases revenue.

👉 Learn how Rivia Health can help you build and automate patient payment plans that truly work. Visit www.riviahealth.com to get started.