The financial health of any healthcare organization—whether a single-location clinic or a sprawling multi-specialty group—is fundamentally tied to how well it manages its revenue cycle. Revenue cycle management (RCM) is more than just billing and collections. It’s a comprehensive process that starts before a patient walks through the door and ends only when the organization has received full payment for its services. From patient registration and insurance verification to claim submission and collections, every step plays a role in determining your financial outcomes.

In today’s environment of rising costs, staff shortages, and increasing patient financial responsibility, optimizing your revenue cycle isn’t optional—it’s mission-critical. The best way to begin this optimization journey is by tracking the right Key Performance Indicators (KPIs). These KPIs shine a light on where your process is strong—and where it’s leaking revenue.

In this blog, we’ll highlight the top five KPIs healthcare leaders must monitor and provide clear, tactical strategies to improve them.

1. Days in Accounts Receivable (A/R)

Why It Matters

Days in A/R tracks the average number of days it takes your organization to collect payment after a service is provided. A high number of days means your cash is tied up in unpaid claims, which strains financial operations and can hinder growth. This KPI reflects both front-end efficiency (like insurance verification) and back-end execution (like claims processing and follow-up).

Industry Benchmark:

The goal is typically 30–40 days. Specialty practices or those with a high volume of complex procedures may see slightly higher averages, but consistent performance above 50 days signals a problem.

How to Improve:

- Automate patient follow-ups: Use intelligent communication tools to send digital reminders for balances, reducing manual work and boosting response rates.

- Verify insurance upfront: Confirm coverage and eligibility at check-in or before the visit to avoid rejections and delays.

- Segment and prioritize A/R aging buckets: Tackle balances 60+ days past due first, particularly those with high-dollar amounts.

- Provide ongoing training: Ensure billing and front-office teams understand the latest payer requirements and coding guidelines.

- Outsource when appropriate: Consider working with RCM vendors for older A/R or specialty claims that are hard to collect in-house.

2. First Pass Resolution Rate (FPRR)

Why It Matters:

FPRR is the percentage of claims paid on the first submission without the need for additional follow-up. It is one of the clearest indicators of your RCM team’s effectiveness in coding, billing, and documentation. A low FPRR means more time and labor are being spent reworking claims, delaying payment and increasing administrative overhead.

Industry Benchmark:

A first pass resolution rate of 90% or higher is considered excellent. Practices below 85% should take urgent corrective steps.

How to Improve:

- Ensure coding accuracy: Leverage AI-powered coding assistants or work with certified professional coders to reduce human error.

- Implement pre-submission quality checks: Catch issues before they result in rejections by using software that checks claims for common errors.

- Update payer rules consistently: Stay proactive about changes in payer policies or fee schedules to avoid unnecessary denials.

- Leverage data analytics: Identify recurring rejection trends and fix their root causes—whether it’s a particular service, provider, or payer.

- Collaborate with clinicians: Educate providers on documentation best practices to ensure clean claims from the outset.

3. Net Collection Rate

Why It Matters:

The net collection rate measures how much of your collectible revenue you’re actually bringing in after factoring in contractual adjustments. It’s one of the most comprehensive measures of how effective your revenue cycle truly is. A poor net collection rate suggests missed revenue opportunities, uncollected balances, and potentially inefficient billing practices.

Industry Benchmark:

95% or higher is considered a healthy net collection rate. Numbers below 90% warrant deeper investigation.

How to Improve:

- Track and pursue underpayments: Regularly audit remittance advice to ensure payers are reimbursing accurately. Challenge discrepancies promptly.

- Accelerate patient payments: Provide frictionless payment options—text-to-pay, mobile wallets, and patient portals—to improve collection speed.

- Enhance patient education: Transparent, upfront financial conversations reduce confusion and improve collections. Use plain language billing statements.

- Segment payers: Analyze payer-specific performance and renegotiate contracts that consistently fall short.

- Adopt performance dashboards: Monitor trends across locations and departments to proactively manage areas where revenue loss may be occurring.

4. Denial Rate

Why It Matters:

Claim denials are costly. Each denied claim represents delayed revenue and additional work for your billing team. The denial rate reveals what percentage of claims are being denied upon first submission. Chronic denial issues can signal systemic problems such as incorrect coding, eligibility errors, or documentation gaps.

Industry Benchmark:

A denial rate under 5% is desirable. Practices approaching or exceeding 10% are likely losing significant revenue.

How to Improve:

- Conduct root cause analysis: Break down denial categories—coding, eligibility, timely filing—and implement targeted fixes.

- Establish a denial appeal workflow: Ensure denied claims are appealed within payer timelines and document outcomes to guide future prevention.

- Educate across the board: Train your front desk, clinical team, and billing staff to prevent errors at every stage of the patient journey.

- Invest in denial management tools: Software can automatically route denied claims to the right team member and track progress in real-time.

- Monitor trends monthly: Look for spikes in denial types that may indicate new payer rules or internal issues.

5. Patient Collection Rate

Why It Matters:

As high-deductible health plans become the norm, patients are responsible for a larger share of healthcare costs. The patient collection rate tracks how effectively your organization collects from patients after insurance. Poor performance here erodes revenue and places greater pressure on administrative teams.

Industry Benchmark:

A patient collection rate of 85% or more is typically considered strong. Falling below this threshold may suggest gaps in communication, technology, or training.

How to Improve:

- Offer accurate upfront estimates: When patients understand their out-of-pocket responsibility early, they’re more likely to pay.

- Provide flexible payment options: Allow installment plans and recurring payments to ease the financial burden.

- Use modern payment tools: Mobile pay, online billing portals, and integrated EHR tools reduce friction and increase success.

- Communicate consistently and clearly: Send automated, friendly reminders across multiple channels—email, text, and calls.

- Simplify billing statements: Replace confusing medical jargon with patient-friendly summaries and visual breakdowns.

Final Thoughts

In today’s value-driven, patient-centric healthcare economy, financial performance and operational efficiency must go hand in hand. While it’s easy to get lost in the sea of data available to healthcare organizations, focusing on these five foundational KPIs—Days in A/R, First Pass Resolution Rate, Net Collection Rate, Denial Rate, and Patient Collection Rate—can transform how your organization measures, manages, and maximizes its revenue cycle.

But simply tracking these numbers isn’t enough. Success lies in taking continuous, proactive steps to act on the data. That means deploying the right technologies, refining workflows, investing in staff training, and maintaining a culture of performance and accountability.

Whether you’re trying to grow your patient base, expand services, or weather industry disruptions, a strong revenue cycle is the backbone that supports your goals. These KPIs are your roadmap—and your early warning system. Get them right, and you’re well on your way to operational excellence and financial sustainability.

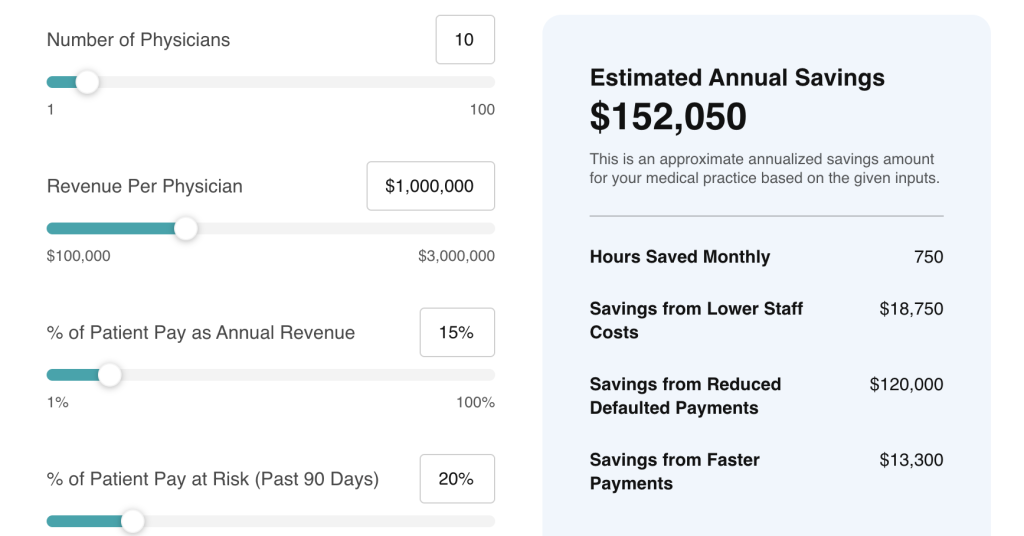

At Rivia Health, we help healthcare practices turn revenue cycle challenges into opportunities. Our platform automates patient communications, streamlines collections, and integrates seamlessly with leading EHRs like athenahealth. With Rivia, your team spends less time chasing payments and more time delivering care.

Let’s turn your revenue cycle into a growth engine—together.